Free Library Card

- For Patrons with valid ID.

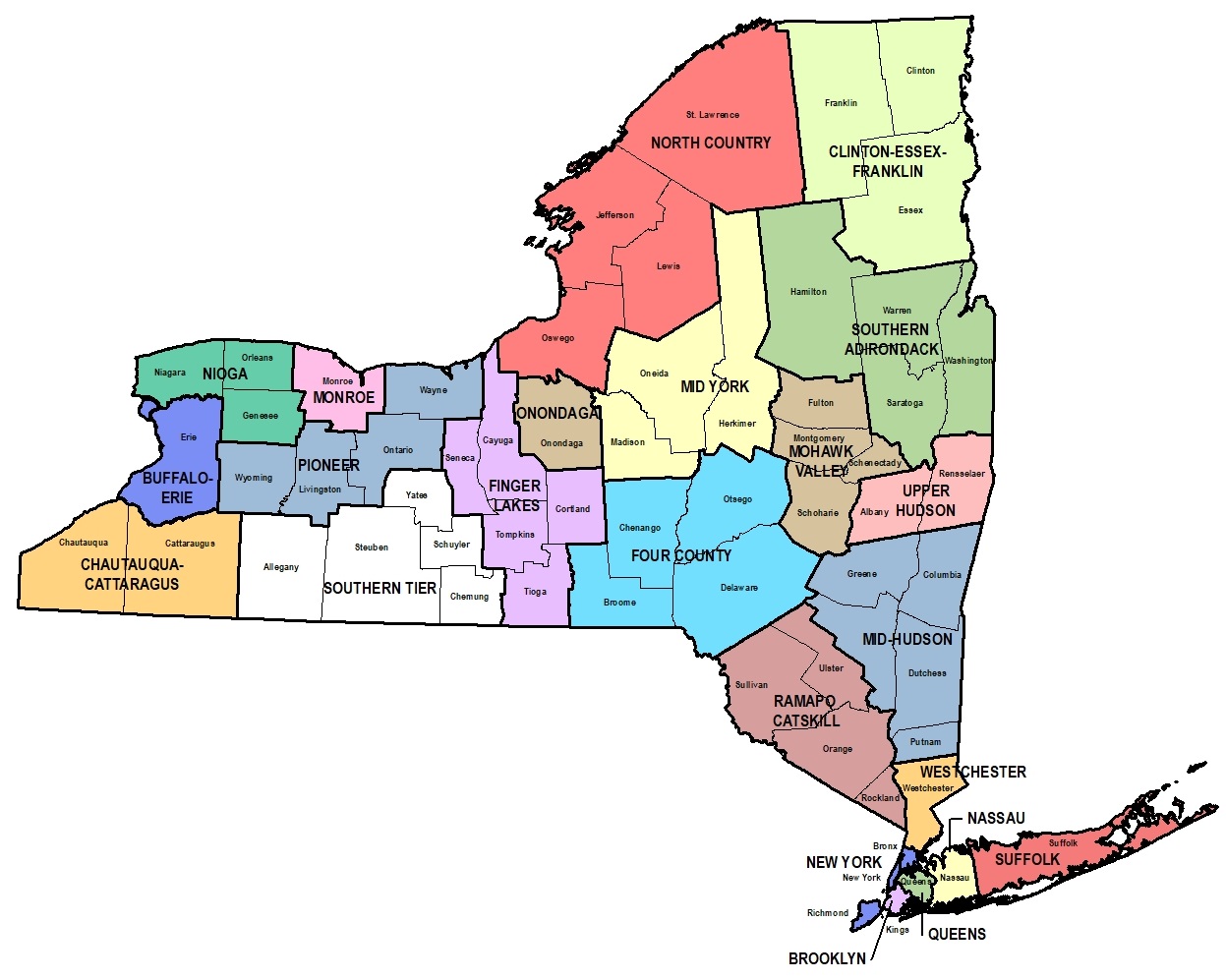

- We are a member of the Southern Adirondack and Mohawk Valley Library Systems. Out of district residents are welcome to a Mechanicville District Library card as well. This will allow access to materials at our Library, as well as those circulating through our inter-library loan program. Circulating materials from the Southern Adirondack Library System as well as the Mohawk Valley Library System will be available to users for pick up at the Mechanicville Library with this card. Please see a clerk for assistance.

- Printable Application for a Mechanicville District Public Library Card

- Online Application For Mechanicville District Public Library Card

Free WiFi

- No password required. Choose LibraryWireless

Free Computer Use:

- With Library card; account must be in good standing. A one-time guest pass will be issued with valid ID, provided the patron is not overdue with Library fines.

Printing:

- Black and white printing is 15 cents per page.

- Color prints are 25 cents per page. Please ask a clerk for assistance.

- Print from your own device! Compose a new email message. Add only the files you wish to print (as attachments). Send email to MECLIBSALS@gmail.com

Faxing:

- Faxing is $1.00 per page. Please ask a clerk for assistance.

Notary Public:

- Free Notary services are available during select hours. Please call to verify. Documents must be signed in presence of Notary Public in order to be notarized.

Museum Passes:

Museum Passes are available to check out with your Library Card for a 3 day loan.

For a list of passes, click here.

Only Mechanicville School District Patrons are eligible to borrow these passes. Passes include free or greatly reduced admission. Please contact the Mechanicville Library or the institution you plan to visit for specific details. Many institutions close throughout the winter.

Late January, 2024.

Tax-Aide provides free tax preparation service at established sites, including electronic filing of returns, usually during the period from late January to mid-April each year. There are no upper or lower income or age limits for Tax-Aide assistance and there is no requirement to be an AARP member.

Each site is staffed by volunteers who are certified by the IRS. They will prepare any federal return that falls within the scope of our volunteer training which includes most items on Form 1040. Some of the items that are out of scope include rental property income (except land only), farm income, certain income items on Schedule K-1, moving expenses, casualty and theft losses, the Alternative Minimum Tax and loss from a self-employment business. They will also prepare state tax returns for the state in which the site is located, if applicable.